Smart minting system

Problem of high rewards

High minting leads to high token price inflation. In other words, high rewards lead to significant token price decrease. As a result if a protocol mints a high token amount as rewards to its users, the users will get almost no value.

Why does it happen?

A protocol mints tokens and gives them to stakers “for free” –> Stakers sell high amounts of the tokens in the market that leads to significant token price decrease.

What minting amount is small and what is too big?

Each swap operation causes a price impact. The more TVL (total value locked) in the pool, the less price impact. As a result if rewards amount (that is sold by users) is small in respect to TVL the price impact of selling all rewards in the market will be inconspicuous

Blueshift’s solution

Blueshift has increased rewards to unprecedented heights so that it will not lead to a significant token price dump.

The solution:

Add BLUES tokens selectively as “anchor” tokens to portfolios.

Connect staking rewards with TVL goals: major part of rewards will be accumulated but not allowed for harvesting unless TVL in all protocol reaches the goal, remaining part is always allowed for harvesting.

Why does it work?

Due to high rewards a lot of users will be attracted. To earn the rewards: Some users will buy BLUES for staking in the yield pools -> buying BLUES leads to price increase Some users will provide liquidity and stake LP tokens to the farms -> providing liquidity leads to protocol TVL.

As a result BLUES price will grow and backed by BLUES “anchor token” liquidity that will grow proportionally to protocol TVL.

When protocol TVL goal is achieved the BLUES price will already have been backed with sufficient BLUES TVL amount in every portfolio. That means that when all accumulated rewards will become available for harvesting, even if all the amount will be sold at the same time there will be no significant price impact because the amount will be not big in comparison to TVL amount reached.

As a final result stakers will get all the rewards and will be able to sell the reward in the market with almost no price impact as well as no bad impact for Blueshift protocol.

Realisation details

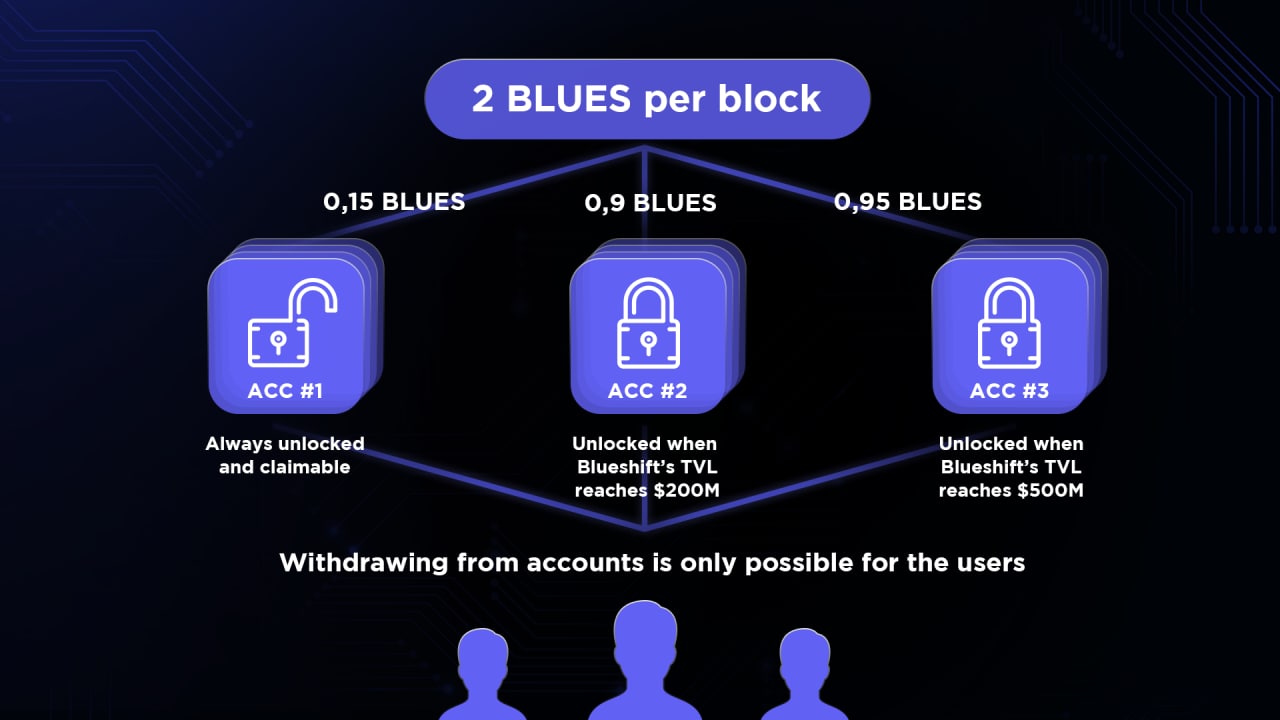

2 BLUES will be minted each block 0.15 BLUES will be distributed immediately among stakers. 1.85 BLUES tokens will be accumulated each block and unlocked for harvesting once specific TVL goals are achieved.

The targets that are set to unlock the massive wave of BLUES token rewards for harvesting are the following:

$ 200 million Total Value Locked(TVL)

$ 500 million Total Value Locked(TVL)

All rewards accrued by the users are distributed immediately across their personal three, yet separated accounts and accumulated (see picture below). One account is immediately available for harvesting, corresponding to 0.15 BLUES per block—as stated previously.

The other two accounts are locked for harvesting until the defined TVL goals are reached. Once the TVL targets are reached the additional BLUES will be claimable via the Blueshift UI.

Last updated